All Categories

Featured

Table of Contents

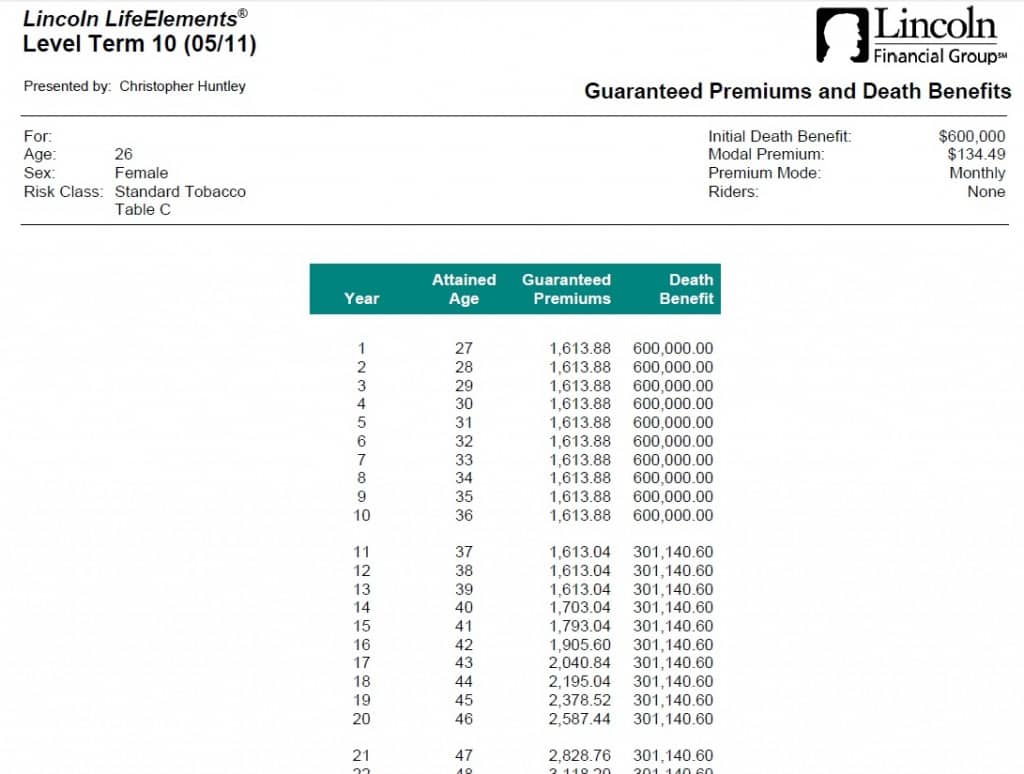

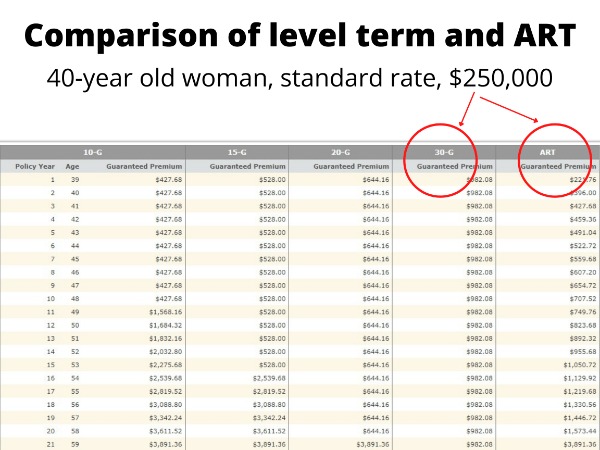

That normally makes them a much more inexpensive alternative permanently insurance coverage. Some term policies may not keep the premium and survivor benefit the same over time. You don't intend to incorrectly think you're acquiring degree term protection and after that have your survivor benefit adjustment later. Many individuals obtain life insurance policy protection to aid economically shield their enjoyed ones in situation of their unexpected fatality.

Or you may have the alternative to transform your existing term insurance coverage into a long-term policy that lasts the remainder of your life. Various life insurance policy policies have possible benefits and disadvantages, so it is very important to comprehend each before you make a decision to buy a plan. There are numerous benefits of term life insurance, making it a preferred choice for insurance coverage.

As long as you pay the premium, your recipients will get the fatality advantage if you die while covered. That claimed, it is necessary to note that a lot of policies are contestable for 2 years which means coverage can be retracted on fatality, must a misrepresentation be discovered in the application. Policies that are not contestable commonly have actually a graded survivor benefit.

Costs are generally reduced than whole life plans. You're not locked into a contract for the rest of your life.

And you can't cash out your policy during its term, so you will not obtain any financial gain from your past coverage. As with various other kinds of life insurance, the cost of a level term plan relies on your age, insurance coverage demands, work, way of living and health. Commonly, you'll find more budget-friendly coverage if you're younger, healthier and less risky to insure.

Long-Term Does Term Life Insurance Cover Accidental Death

Since degree term costs remain the very same for the period of protection, you'll understand precisely just how much you'll pay each time. Degree term coverage additionally has some versatility, permitting you to personalize your plan with additional features.

You might have to satisfy specific problems and qualifications for your insurer to establish this motorcyclist. There also might be an age or time limit on the insurance coverage.

The survivor benefit is commonly smaller, and protection typically lasts up until your youngster turns 18 or 25. This biker may be a more economical method to help ensure your children are covered as riders can usually cover multiple dependents simultaneously. As soon as your child ages out of this insurance coverage, it may be feasible to transform the biker right into a brand-new policy.

The most common type of irreversible life insurance policy is whole life insurance policy, but it has some essential differences compared to level term insurance coverage. Right here's a fundamental review of what to think about when contrasting term vs.

The Combination Of Whole Life And Term Insurance Is Referred To As A Family Income Policy

Whole life insurance lasts insurance coverage life, while term coverage lasts for a specific periodCertain The costs for term life insurance policy are typically lower than entire life protection.

One of the major functions of degree term protection is that your costs and your fatality advantage do not alter. You might have protection that begins with a fatality benefit of $10,000, which might cover a home loan, and then each year, the fatality benefit will certainly decrease by a set amount or percent.

Because of this, it's often an extra cost effective type of degree term insurance coverage. You might have life insurance through your employer, but it may not suffice life insurance policy for your needs. The initial step when acquiring a policy is figuring out just how much life insurance policy you need. Consider aspects such as: Age Family members dimension and ages Work condition Earnings Financial obligation Way of living Expected last expenditures A life insurance policy calculator can help determine just how much you require to begin.

After choosing a plan, finish the application. For the underwriting procedure, you may need to give basic personal, health and wellness, way of life and work details. Your insurance firm will certainly figure out if you are insurable and the danger you might offer to them, which is shown in your premium costs. If you're accepted, authorize the paperwork and pay your very first costs.

Expert Term To 100 Life Insurance

Finally, think about scheduling time each year to review your plan. You might intend to update your recipient information if you've had any type of substantial life adjustments, such as a marriage, birth or separation. Life insurance policy can often feel challenging. But you don't need to go it alone. As you explore your choices, consider reviewing your requirements, wants and interests in an economic professional.

No, level term life insurance policy doesn't have cash money worth. Some life insurance plans have an investment feature that enables you to build cash money worth with time. A part of your premium settlements is alloted and can gain rate of interest over time, which grows tax-deferred during the life of your coverage.

You have some choices if you still desire some life insurance coverage. You can: If you're 65 and your coverage has run out, for example, you might desire to purchase a new 10-year level term life insurance coverage policy.

Tax-Free Direct Term Life Insurance Meaning

You might have the ability to convert your term insurance coverage right into an entire life policy that will last for the remainder of your life. Several sorts of level term plans are exchangeable. That suggests, at the end of your coverage, you can convert some or all of your policy to whole life protection.

Level term life insurance policy is a plan that lasts a set term usually between 10 and 30 years and features a degree fatality advantage and degree costs that remain the exact same for the whole time the plan holds. This implies you'll understand precisely just how much your repayments are and when you'll need to make them, permitting you to spending plan accordingly.

:max_bytes(150000):strip_icc()/Investopedia-terms-termlife-6451fde927474d4f8a81a5681efd393f.jpg)

Level term can be a fantastic option if you're looking to purchase life insurance policy protection for the very first time. According to LIMRA's 2023 Insurance Measure Study, 30% of all grownups in the United state requirement life insurance policy and don't have any type of plan. Level term life is foreseeable and budget-friendly, that makes it among one of the most prominent sorts of life insurance policy.

Latest Posts

Mutual Of Omaha Final Expense Insurance

Does Medicare Cover Funeral Expenses

Final Expense Life Insurance South Carolina