All Categories

Featured

Table of Contents

That normally makes them a much more economical alternative for life insurance coverage. Numerous individuals obtain life insurance protection to help financially protect their enjoyed ones in instance of their unanticipated fatality.

Or you may have the option to transform your existing term coverage into a permanent policy that lasts the remainder of your life. Numerous life insurance policy plans have potential advantages and downsides, so it's important to recognize each before you determine to buy a plan.

As long as you pay the premium, your recipients will receive the fatality advantage if you pass away while covered. That claimed, it is necessary to keep in mind that many policies are contestable for 2 years which means coverage can be rescinded on death, must a misstatement be located in the app. Plans that are not contestable often have actually a rated survivor benefit.

Costs are usually lower than whole life policies. You're not locked right into a contract for the remainder of your life.

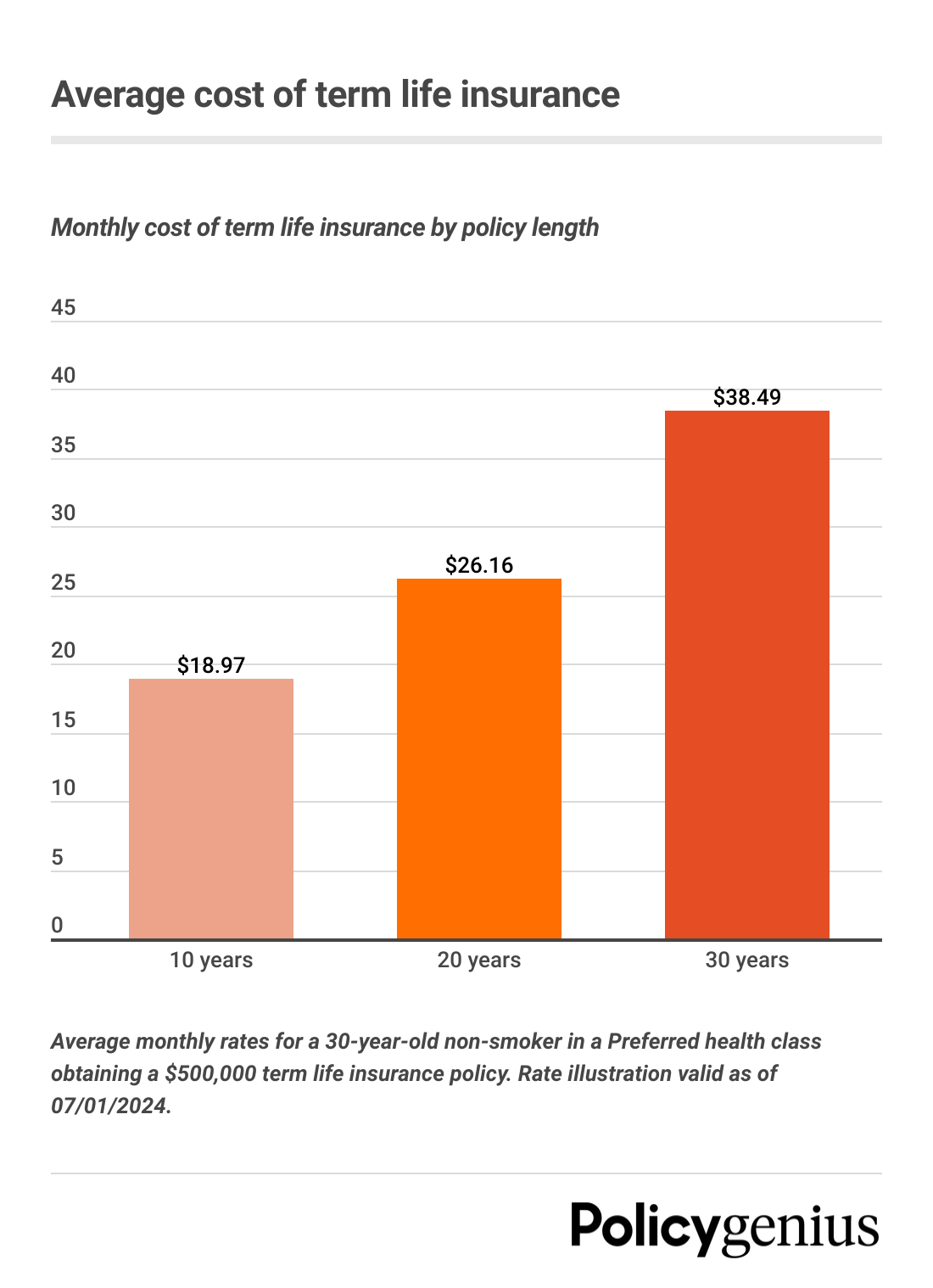

And you can't pay out your plan during its term, so you will not receive any type of economic benefit from your previous protection. Similar to various other kinds of life insurance policy, the expense of a level term plan depends upon your age, protection requirements, work, way of life and health and wellness. Normally, you'll locate more budget friendly coverage if you're more youthful, healthier and less risky to guarantee.

Value Decreasing Term Life Insurance Is Often Used To

Considering that level term premiums remain the very same for the duration of insurance coverage, you'll understand exactly just how much you'll pay each time. That can be a big assistance when budgeting your expenses. Level term coverage likewise has some flexibility, enabling you to customize your policy with extra functions. These frequently come in the kind of riders.

You may need to meet specific conditions and credentials for your insurance firm to enact this biker. In enhancement, there might be a waiting period of approximately 6 months prior to taking effect. There additionally might be an age or time frame on the insurance coverage. You can add a youngster rider to your life insurance policy policy so it also covers your youngsters.

The survivor benefit is generally smaller sized, and protection normally lasts till your child turns 18 or 25. This motorcyclist may be an extra economical means to assist guarantee your kids are covered as cyclists can often cover several dependents simultaneously. As soon as your kid ages out of this insurance coverage, it may be possible to transform the cyclist right into a new policy.

The most usual kind of permanent life insurance coverage is entire life insurance coverage, yet it has some essential distinctions contrasted to level term coverage. Below's a fundamental introduction of what to take into consideration when comparing term vs.

Exceptional Term 100 Life Insurance

Whole life entire lasts insurance policy life, while term coverage lasts for a specific periodDetails The costs for term life insurance are typically lower than whole life coverage.

One of the major functions of level term protection is that your premiums and your fatality advantage do not change. You might have coverage that begins with a fatality benefit of $10,000, which could cover a home mortgage, and after that each year, the fatality benefit will decrease by a set quantity or portion.

Due to this, it's frequently a more budget-friendly kind of degree term insurance coverage., however it may not be enough life insurance coverage for your demands.

After determining on a plan, finish the application. If you're accepted, authorize the paperwork and pay your first premium.

Honest The Combination Of Whole Life And Term Insurance Is Referred To As A Family Income Policy

You might want to upgrade your beneficiary information if you've had any type of significant life changes, such as a marital relationship, birth or separation. Life insurance policy can occasionally feel complicated.

No, level term life insurance policy doesn't have cash money worth. Some life insurance policy plans have an investment feature that enables you to construct cash money value gradually. A section of your premium payments is alloted and can gain rate of interest in time, which expands tax-deferred during the life of your coverage.

Nonetheless, these plans are typically considerably much more pricey than term coverage. If you get to completion of your plan and are still to life, the insurance coverage ends. You have some alternatives if you still desire some life insurance protection. You can: If you're 65 and your coverage has run out, for instance, you may wish to buy a brand-new 10-year level term life insurance policy policy.

Innovative Guaranteed Issue Term Life Insurance

You may have the ability to transform your term coverage right into a whole life policy that will last for the rest of your life. Lots of sorts of degree term plans are convertible. That indicates, at the end of your protection, you can convert some or all of your plan to whole life insurance coverage.

Degree term life insurance policy is a policy that lasts a set term typically in between 10 and 30 years and comes with a degree death advantage and level costs that remain the same for the whole time the plan is in impact. This means you'll recognize precisely just how much your repayments are and when you'll have to make them, allowing you to budget plan as necessary.

Degree term can be an excellent alternative if you're seeking to purchase life insurance policy protection for the very first time. According to LIMRA's 2023 Insurance Measure Study, 30% of all grownups in the U.S. demand life insurance policy and do not have any kind of type of plan. Degree term life is foreseeable and economical, that makes it among the most prominent kinds of life insurance coverage.

Latest Posts

Define Mortgage Insurance

Best Annual Renewable Term Life Insurance

Secure Term Life Insurance For Couples